Navinci Diagnostics AB, a Swedish life science company developing innovative tools for spatial proteomics research, announces the closing of SEK 90 million financing. The round was led by Segulah Medical Acceleration (”SMA”), a Scandinavia-based life science-focused investment company, together with existing shareholders, including Landegren Gene Technology AB, Nexttobe AB, and Beijer Ventures AB.

Navinci Diagnostics AB announces closing of SEK 90M Series A financing, led by Segulah Medical Acceleration with support from existing shareholders

Navinci Diagnostics AB, a Swedish life science company developing innovative tools for spatial proteomics research, announces the closing of SEK 90 million financing. The round was led by Segulah Medical Acceleration (”SMA”), a Scandinavia-based life science-focused investment company, together with existing shareholders, including Landegren Gene Technology AB, Nexttobe AB, and Beijer Ventures AB.

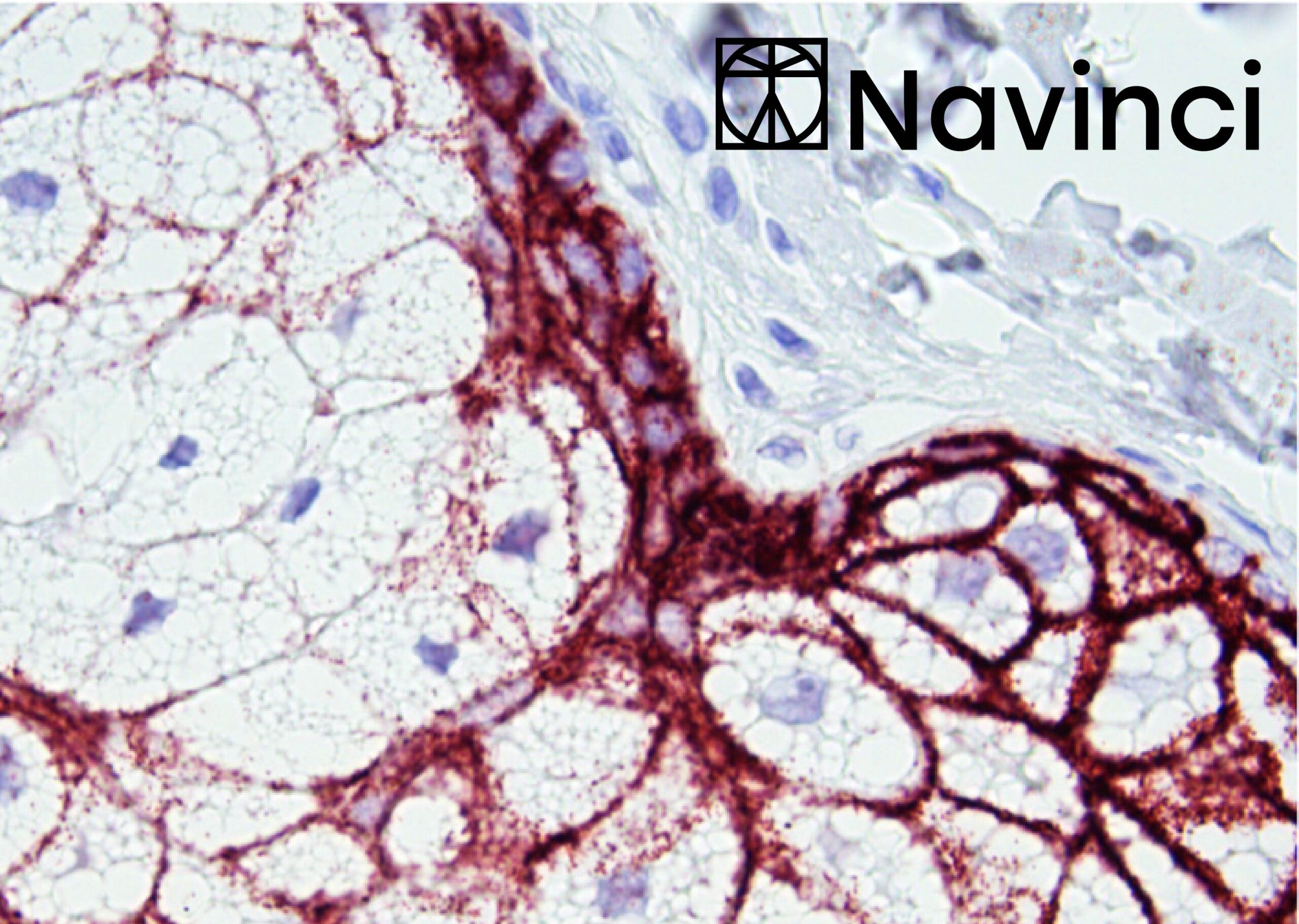

Proteins exert the majority of their physiological functions in cells and tissues by undergoing modifications and forming dynamic complexes – effects that cannot be explored by genomics, transcriptomics or conventional immunostaining methods. Navinci advances spatial proteomics by launching high-performance assay kits, based on proprietary in situ Proximity Ligation Assay technology for the analysis of proteins, as well as their interactions and modifications. The technology offer a deeper understanding of proteins and their activity states in normal and diseased cells and tissues, in both academic and industrial research. In particular, Navinci’s technology is an essential tool for detecting immune checkpoints, improving patient stratification and monitoring treatment effects in pharmaceutical research.

Navinci will soon launch the first commercially available assay to accurately detect interaction between the programmed cell death protein 1 (PD1) and PD1-ligand (PD-L1) checkpoint in tissue samples. This is the first step in building a complete portfolio of assays for immuno-oncology research and drug development. Immune checkpoint inhibitors have provided a substantial breakthrough in cancer immunotherapy, and there are more than 3000 anti-PD1/PD-L1 therapies currently in clinical trials. The main technology currently used to determine whether a patient is likely to benefit from PD1/PD-L1 immunotherapy is PD-L1 immunohistochemistry. However, this test fails to reveal PD1/PD-L1 interactions and has been shown to correlate poorly with patient response to treatment.

Navinci’s technology can enhance understanding of how drugs exert their effects, with the potential to improve clinical trial outcomes and achieve more effective treatments. Navinci also offers flexible solutions (NaveniTMFlex) which allow scientists to study any protein or protein interaction in tissue or cell samples, with greater accuracy than conventional immunofluorescence or immunohistochemistry.

There is a significant unmet need for diagnostic immuno-oncological methods that can convey important clinical information; hence, the global market potential is large and growing rapidly. With the recent financing, Navinci will accelerate international commercialization and partner with pharma companies, as well as companies with complementary technologies, to offer complete solutions for its customers. Navinci strives to build the largest and most useful portfolio of assays to study protein interplay in immuno-oncology, while also expanding into other research areas.

“I am incredibly excited about what we have accomplished so far, the journey Navinci is now on, and the path we have set for ourselves. I’m proud of the confidence in our technology and in our team that is shown by existing and new owners. With the inclusion of SMA among Navinci’s shareholders, we gain financial resources to realize our ambitious vision of becoming a leader in spatial proteomics. Equally important, we join forces with one of the most vital investors in Scandinavia and gain access to their excellent life science network in Europe and the USA. Our leadership team and the board of directors share SMA´s vision and core values, and we complement each other in a very positive way. We will now begin expanding our Sales & Marketing and R&D teams with talented and ambitious co-workers who resonate with our company values. Open positions will be announced shortly.” – Robert Gunnarsson, CEO of Navinci Diagnostics AB.

“Segulah Medical Acceleration is pleased to be leading Navinci’s SEK 90 million Series A financing. Navinci, through its Naveni Proximity Ligation technology, is uniquely positioned to be a core part of the spatial biology revolution as it accelerates. The track record of Ulf Landegren and his colleagues – scientific founders of Navinci as well as other successful companies, including Olink Proteomics and Q-Linea – is something that SMA has deep and longstanding admiration for. Together with the Navinci management team, we look forward to providing the resources and guidance to enable the next few steps on what we think will be a long and successful commercial journey.” – Roger Gunnarsson, Managing Partner at SMA.

About Navinci

Navinci (formerly known as Olink Bioscience) is a Swedish life science company that develops and markets in situ proximity ligation assays to detect proteins, their interactions, and modifications in tissue and cell samples, with initial focus on immuno-oncology research and drug development. The technology provides an essential tool for studying spatial biology with high specificity and directly reveal responses to disease and drug treatment in tissue microenvironments.

www.navinci.se

About SMA

Segulah Medical Acceleration (“SMA”) is a Scandinavia-based investment company focusing on innovative medical technology companies with global potential. SMA’s objective is to be an active partner and help its portfolio companies accelerate growth and internationalization and reach commercial proof of concept. SMA’s geographic investment remit is focused on Scandinavia and other Western European countries. The areas within Medtech that SMA prioritizes include medical devices and consumables, diagnostics, life science tools, and digital technologies. SMA has more than SEK 1.25 billion (€ 125m equivalent) in investable funds.

www.segulahmedical.com